The Buzz on Tax Amnesty 2021

Wiki Article

The Single Strategy To Use For Tax

Table of ContentsFacts About Tax Avoidance RevealedThe Ultimate Guide To TaxTax Amnesty Meaning for BeginnersTax Accounting - The FactsIndicators on Tax You Need To Know

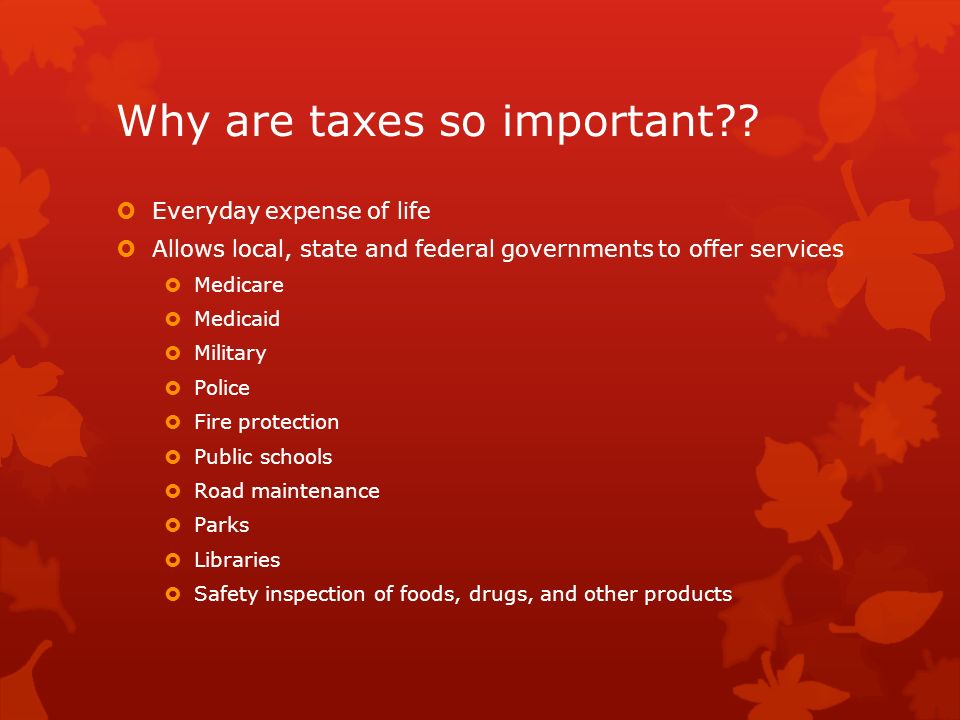

Governments impose fees on their people as well as businesses as a way of increasing earnings, which is then utilized to fulfill their financial demands. This consists of funding government as well as public projects along with making the company setting in the nation conducive for economic development. Without tax obligations, governments would be incapable to fulfill the demands of their cultures.

Good administration makes sure that the money gathered is made use of in a way that benefits citizens of the country. This cash likewise goes to pay public slaves, authorities policemans, participants of parliaments, the postal system, as well as others.

In addition to social tasks, federal governments also use cash gathered from taxes to fund industries that are essential for the health and wellbeing of their residents such as security, scientific study, environmental defense, and so on. Some of the cash is also directed to fund jobs such as pension plans, joblessness advantages, childcare, etc. Without tax obligations it would certainly be impossible for governments to raise cash to money these kinds of tasks.

Some Known Details About Tax Amnesty Meaning

For organization to grow in the nation, there needs to be great facilities such as roadways, telephones, electrical power, and so on. This facilities is developed by governments or with close participation of the government. When federal governments collect money from taxes, it ploughs this money into advancement of this framework and in turn promotes economic activity throughout the nation.Taxes help elevate the standard of living in a country. The greater the requirement of living, the stronger and also higher the degree of consumption more than likely is. Organizations flourish when there is a market for their product and also solutions. With a higher criterion of living, services would be ensured of a higher residential consumption.

This is why it is essential that people strive to pay taxes and understand that it is meant to be more than simply a "money grab" from the government. Certified Public Accountant Company Consulting Structure Your Monetary Success Relevance of Keeping Track of Your Expenditures.

Some Known Factual Statements About Tax Amnesty Meaning

Note: the partnerships are substantial at the 1% degree and continue to be substantial when regulating for revenue per head. The quantity of the tax cost for organizations matters for investment and also growth. Where tax obligations are high, organizations are much more inclined to pull out of the formal market. A research reveals that higher tax obligation rates are connected with less formal services and also reduced exclusive financial investment.Maintaining tax rates at a sensible degree can motivate the growth of the exclusive market and the formalization of organizations. Enforcing high tax obligation expenses on organizations of this dimension could not add much to federal government tax profits, however it could create companies to relocate to the casual market or, even worse, cease procedures.

The program reduced total tax prices by 8% and contributed to an increase of 11. 6% in the company licensing rate, a 6. 3% increase in the registration of microenterprises as well as a 7. 2% increase in the number of companies registered with the tax authority. Profits collections climbed by 7.

Economic advancement often increases the requirement for new tax earnings to fund climbing public expense. In establishing economic situations high tax prices and weak tax obligation administration are not the only factors for reduced rates of tax collection.

Top Guidelines Of Tax Amnesty 2021

In more helpful hints Qatar and also Saudi Arabia, it would have to make four payments, still amongst the lowest worldwide. In Estonia, following revenue tax obligation, value added tax (VAT) as well as labor tax obligations and payments takes just 50 hours a year, around 6 working days. Research discovers that it takes an Operating study company much longer typically to abide by barrel than to adhere to company revenue tax.Research study shows that this is discussed by variations in administrative methods and in exactly how barrel is executed. Conformity has a tendency to take less time in economic situations where the exact same tax authority administers VAT as well as corporate income tax obligation. Using on-line declaring as well as settlement also significantly lowers conformity time. Regularity as well as length of barrel returns also matter; requirements to send invoices or other documentation with the these details returns contribute to compliance time.

Commonly, the challenge of taxes begins after the tax return has actually been submitted. Postfiling processessuch as claiming a barrel refund, undergoing a tax obligation audit or appealing a tax obligation assessmentcan be the most challenging interaction that a company has with a tax authority. Businesses may have to invest more effort and time right into the procedures occurring after declaring of income tax return than right into the normal tax obligation conformity procedures.

In principle, VAT's statutory incidence gets on the final customer, out organizations. According to tax obligation policy standards set out by the Organisation for Economic Co-operation as well as Development (OECD), a VAT system must be neutral as well as reliable. The lack of an effective barrel reimbursement system for companies with an excess input barrel in a given tax obligation period will certainly threaten this goal.

Not known Factual Statements About Tax Avoidance And Tax Evasion

Hold-ups and also inadequacies in the barrel reimbursement systems are usually the outcome of fears that the system may be over used and also susceptible to scams.18 Relocated by this problem, lots of economic climates have tax burden developed actions to moderate and also restrict the choice to the barrel reimbursement system and also subject the refund declares to extensive procedural checks.The Operating instance research company, Taxpayer, Co., is a residential service that does not trade internationally. It does a basic commercial and business activity and it is in its 2nd year of procedure. Taxpayer, Co. satisfies the VAT threshold for enrollment and its month-to-month sales and also regular monthly operating budget are repaired throughout the year, causing a positive result barrel payable within each accountancy period.

Report this wiki page